The management team may raise the funds essential for a buyout through a private equity business, which would take a minority share in the company in exchange for financing. It can likewise be utilized as an exit method for company owners who wish to retire - . A management buyout is not to be confused with a, which takes location when the management team of a different company buys the company and takes control of both management obligations and a controlling share.

Leveraged buyouts make good sense for business that wish to make significant acquisitions without investing too much capital. The possessions of both the obtaining and obtained companies are used as security for the loans to fund the buyout. An example of a leveraged buyout is the purchase of Health center Corporation of America in 2006 by private equity companies KKR, Bain & Company, and Merrill Lynch.

Sign up to receive the https://vimeopro.com most recent news on alternative financial investments (). Your information will * never ever * be shared or offered to a 3rd celebration.

Here are some other matters to think about when considering a strategic purchaser: Strategic buyers might have complementary product and services that share typical circulation channels or customers. Strategic purchasers typically anticipate to buy 100% of the business, hence the seller has no chance for equity appreciation. Owners seeking a quick transition from business can expect to be replaced by a skilled individual from the purchasing entity.

Current management might not have the appetite for severing traditional or tradition portions of the company whereas a new supervisor will see the company more objectively. As soon as a target is developed, the private equity group starts to accumulate stock in the corporation. With significant collateral and massive loaning, the fund ultimately achieves a bulk or acquires the total shares of the business stock.

Since the economic crisis has subsided, private equity is rebounding in the United States and Canada and are as soon as again ending up being robust, even in the face of stiffer policies and lending practices. How is a Private Equity Different from Other Investment Classes? Private equity funds are significantly various from traditional mutual funds or EFTs - .

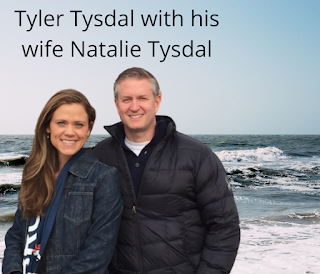

Additionally, maintaining stability in the funding is Tyler Tysdal needed to sustain momentum. The typical minimum holding time of the financial investment differs, however 5. 5 years is the average holding duration needed to achieve a targeted internal rate of return which might be 20% to 30%. Private equity activity tends to be based on the exact same market conditions as other investments.

, Canada has been a beneficial market for private equity deals by both foreign and Canadian concerns. Conditions in Canada assistance ongoing private equity investment with strong financial efficiency and legal oversight comparable to the United States.

We hope you discovered this article insightful - . If you have any questions about alternative investing or hedge fund investing, we welcome you to contact our Montreal Hedge Fund. It will be our enjoyment to address your questions about hedge fund and alternative investing strategies to much better complement your investment portfolio.

, Managing Partner and Head of TSM.

We utilize cookies and similar tools to analyze the use of our site and offer you a much better experience. Your continued usage of the website suggests that you consent to our cookies and similar tools.

We, The Riverside Company, utilize analytical cookies to keep track of how you and other visitors use our site.

On the planet of investments, private equity refers to the investments that some financiers and private equity firms straight make into a business. Private equity investments are mostly made by institutional financiers in the type of endeavor capital financing or as leveraged buyout. Private equity can be used for many functions such as to buy upgrading technology, expansion of the organization, to obtain another company, or perhaps to restore a stopping working organization.

There are lots of exit techniques that private equity investors can utilize to unload their investment. The main options are talked about below: One of the common ways is to come out with a public offer of the company, and offer their own shares as a part of the IPO to the general public.

Stock exchange flotation can be utilized just for huge business and it should be practical for the business because of the expenses included. Another option is tactical acquisition or trade sale, where the company you have purchased is sold to another suitable company, and then you take your share from the sale value.